gratuity calculator mohre that The Ministry of Human Resources and Emiratisation (MOHRE) in the United Arab Emirates provides to help employers and employees calculate end-of-service gratuity payments.

gratuity calculator mohre uae

gratuity calculator mohre uses the UAE Labor Law to calculate the gratuity amount based on the number of years of service and the employee’s basic salary. The gratuity amount is equivalent to a certain number of days of basic salary, as follows:

- 21 days’ salary for each year of the first five years of service.

- 30 days’ salary for each year of service after the first five years.

also know about: www.mohre.gov.uae link

mohre gratuity calculator online

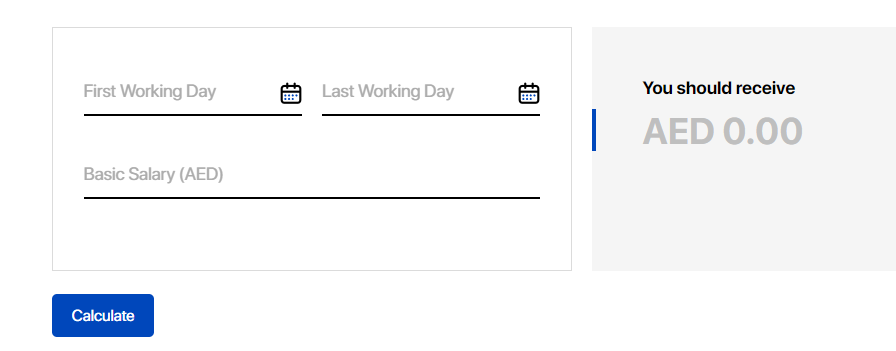

you can calculate mohre gratuity online by following these steps:

- go to the calculate gratuity website “from here“.

- Enter your Employment Details including:

- First Working Day.

- Last Working Day.

- Basic Salary (AED).

- click on “calculate”.

how to calculate gratuity in uae for unlimited contract

to calculate gratuity in uae for an unlimited contract you should be attentive to this information:

- Period of employment less than 1 year

- The employee is not entitled to any gratuity payment.

- Period of employment between 1 year to 5 years

- The employee is entitled to a gratuity payment.

- The gratuity payment is calculated based on 21 days’ salary for each year of work.

- Period of service of more than 5 years:

- The employee is entitled to a gratuity payment.

- The gratuity payment is calculated based on 30 days’ salary for each year of work after the first five years.

- In addition to step 2, the employee is entitled to 21 days’ basic salary for each year of work during the first five years of employment.

- Total gratuity payment

- The total gratuity payment should not exceed two years’ worth of the employee’s basic salary.

- Assumption

- This gratuity entitlement calculation assumes that the employee has completed their limited-term employment contract with their employer.

gratuity calculator for unlimited contract example

here’s an example to illustrate the gratuity entitlement calculation based on the period of employment:

Let’s assume an employee has worked with their employer for 7 years and their basic salary is AED 5,000 per month.

- Period of employment less than 1 year: The employee is not entitled to any gratuity payment.

- Period of employment between 1 year to 5 years: The employee has worked for 4 years (between 1 year to 5 years), so they are entitled to a gratuity payment of 21 days’ salary x 4 years x (AED 5,000 / 30) = AED 14,000

- Period of service more than 5 years: The employee has worked for 7 years, so they are entitled to a gratuity payment of 30 days’ salary x 2 years x (AED 5,000 / 30) = AED 10,000 (for the years 6 and 7); 21 days’ basic salary x 5 years x AED 5,000 = AED 52,500 (for the years 1 to 5)

- Total = AED 10,000 + AED 52,500 = AED 62,500

- Total gratuity payment cannot exceed two years’ worth of the employee’s basic salary, which is: 2 years x AED 5,000 x 12 = AED 120,000

- Since AED 62,500 is less than AED 120,000, the employee is entitled to a gratuity payment of AED 62,500.

- Assumption: This gratuity entitlement calculation assumes that the employee has completed their limited-term employment contract with their employer.

also know about mohre employee services list

gratuity calculator uae mohre link

you can visit the Gratuity Calculator website from the link below dda.gov.ae, where you can Enter your Employment Details to calculate your gratuity online and specify.

gratuity calculator mohre uae 2023 can be done by following the steps and link that we give in this article.

Frequently asked questions

If an employee has worked for less than one year, they are not entitled to gratuity.

If an employee has worked for one to five years, they are entitled to 21 days’ basic salary for each year of work.

If an employee has worked for more than five years, they are entitled to 30 days’ basic salary for each year of work after the first five years, in addition to 21 days’ basic salary for each year of work during the first five years of employment.

اترك تعليقا